Introduction

Have you ever watched the stock market tumble and felt a sudden pang of fear, wondering if your retirement savings would weather the storm? Market downturns can feel alarming, especially when you’re no longer drawing a salary and have to rely on fixed sources of income. They matter because your retirement nest egg isn’t just a collection of numbers; it represents years of hard work, security, and cherished dreams of a comfortable life after decades of employment.

So, what should retired people do during market downturns to avoid panic and preserve their financial well-being? In this comprehensive guide, we’ll delve into practical strategies—from rebalancing your portfolio to adjusting your budget—that can help you safeguard your savings when the market turns volatile. Whether you’re a new retiree or someone who’s been out of the workforce for years, these insights will empower you to make wiser financial decisions in turbulent times.

Understanding Market Downturns

The Nature of Economic Cycles

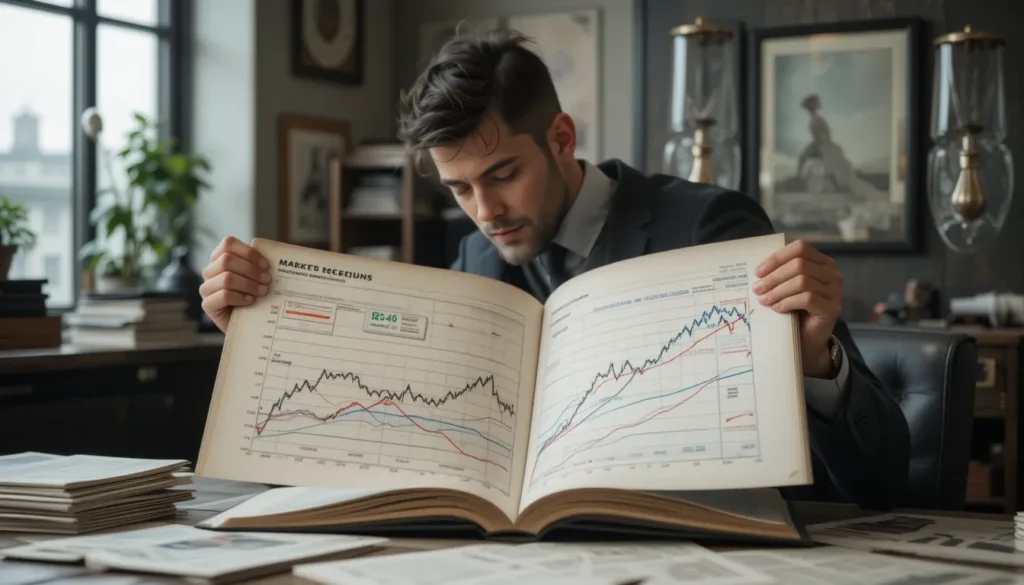

Recessions and bear markets are a natural part of the economic cycle. According to data from the National Bureau of Economic Research, the U.S. economy has experienced multiple contractions and expansions over the past century. Each downturn eventually gave way to a recovery phase. While it’s never pleasant to see your investments shrink, history shows that markets are resilient over the long term.

Why Downturns Feel Scarier in Retirement

When you’re working, market dips can feel like temporary setbacks. You still have a paycheck, and time is on your side to help your portfolio recover. In retirement, however, you no longer have that steady income stream from employment. Each down market can feel like a threat to your financial security—after all, you’re drawing on your savings for living expenses. This heightened sense of vulnerability explains why retirees often worry more during these periods.

I recall my uncle, who retired just before the 2008 financial crisis, waking up every morning to check the stock ticker. The stress of seeing daily losses got to him. But as he later learned, making impulsive decisions out of fear can be the real threat to a well-planned retirement.

Keep a Long-Term Perspective

Avoid Emotional Investing

It’s natural to feel anxious when markets plummet. However, emotional decisions often lead to locking in losses. Selling off assets in a panic crystallizes any downturn-related drop in value, leaving you less positioned to benefit from an eventual rebound. Research by DALBAR, a financial services market research firm, consistently shows that individual investors who attempt to time the market typically underperform those who stay invested.

Key Takeaway:

- Resist knee-jerk reactions.

- Remember your original goals.

- Understand that market recoveries can happen faster than you might expect.

Historical Recovery Timelines

The market’s track record of rebounding after downturns is encouraging. For instance, the S&P 500 eventually recovered after the dot-com bubble burst in the early 2000s, after the 2008 financial crisis, and even after the sharp drop in March 2020 caused by the pandemic. While past performance doesn’t guarantee future results, these examples demonstrate the resilience of diversified portfolios over time.

According to Fidelity, the average bear market lasts roughly 9-14 months, but bull markets tend to last much longer, often leading to overall gains in a well-structured, long-term portfolio.

Assess and Adjust Your Portfolio

Revisit Your Asset Allocation

As a retiree, the way your money is split among stocks, bonds, and other asset classes (like cash or real estate) should reflect your current risk tolerance and income needs. If you’ve been in retirement for a few years, your initial portfolio might have drifted away from its target allocation due to market fluctuations. In a downturn, this could mean you’re overexposed to volatile assets, like equities.

- Rebalancing Strategy:

- Identify your ideal asset allocation (e.g., 40% stocks, 50% bonds, 10% cash).

- Compare to your actual allocation.

- Sell overweight positions and add to underweight ones to restore balance.

This process can help you systematically buy low and sell high. For instance, if your stocks have declined more than your bonds, you’d sell a portion of bonds to buy more equities, effectively purchasing them at discounted prices.

Consider Defensive Investments

If market volatility is keeping you up at night, it might be time to shift a portion of your portfolio into more stable assets. High-quality bonds, dividend-paying blue-chip stocks, or even certain types of annuities can reduce the impact of a stock market downturn. While nothing guarantees zero risk, diversifying with more conservative investments can ease the emotional burden of market swings.

Pro Tip:

Dividend-paying stocks can provide an income stream that’s less tied to daily price fluctuations. Even if the market dips, you’ll still collect dividends, which can help cover living expenses or be reinvested.

Evaluate Your Withdrawal Rate

The 4% Rule—Useful but Not a Hard-and-Fast Law

Financial planners often mention the “4% rule” as a guideline for safe withdrawal rates. In theory, you can withdraw 4% of your savings annually (adjusted for inflation), and your nest egg should last about 30 years. However, economic conditions change, and a severe market downturn can shrink your portfolio faster than you anticipate.

- Adjusting Withdrawals:

- If you can afford to, scale back discretionary spending until the market recovers.

- Revisit your annual budget to see if you can reduce that withdrawal to 3% or 3.5% temporarily.

Flexible Spending Strategy

Imagine you have two categories of retirement expenses: essential (housing, utilities, healthcare, groceries) and non-essential (travel, dining out, hobbies). In a down market:

- Cover your essential expenses with more stable income sources like Social Security, pensions, or bond interest.

- Temporarily cut or postpone big-ticket non-essentials (like a luxury vacation).

- Reassess every six to twelve months, or once the market shows signs of recovery.

This flexibility can help cushion your portfolio, reducing withdrawals when account balances are already under stress.

Strengthen Your Cash Reserves

The Role of an Emergency Fund in Retirement

While you’re no longer saving for major life goals, having liquid assets on hand can still be a lifesaver. If you face a sudden medical bill or an unexpected home repair during a market slump, tapping your investment portfolio while asset prices are low means you might have to sell at a loss.

Recommendation:

Keep 6-12 months’ worth of living expenses in a savings account or money market fund. This buffer gives you time to wait for the market to stabilize before making any major withdrawals.

Short-Term vs. Long-Term Savings

Besides an emergency fund, consider segmenting your retirement assets into different “buckets” based on time horizon:

- Short-Term Bucket (1-3 years): Cash or near-cash investments for monthly bills and immediate needs.

- Mid-Term Bucket (3-7 years): Bonds or conservative funds for moderate growth.

- Long-Term Bucket (7+ years): Stocks and more aggressive vehicles for potential higher returns over time.

This bucket strategy can help you visualize which pool of money to draw from in a downturn, and which to leave untouched for future growth.

Explore Alternative Income Streams

Part-Time Work or Consulting

Retirement doesn’t have to mean zero earned income. Some retirees enjoy part-time work or consulting in their former industry. Even a modest trickle of extra cash can reduce your reliance on portfolio withdrawals, especially during market dips.

- Examples:

- Teaching a course at a community college.

- Freelancing or consulting in your field of expertise.

- Monetizing a hobby, such as selling handmade crafts or giving music lessons.

This approach not only bolsters your finances but can also offer social interaction and a sense of purpose.

Rental Income and Room Sharing

If you have extra space in your home or an investment property, renting it out can provide regular income. Platforms like Airbnb or VRBO (for short-term stays) or traditional long-term leases can give you a stable cash flow that’s less correlated with the stock market.

Think of it as your dog house paying the bills. Why let that spare room sit idle when it could help cover your grocery costs or keep you traveling during retirement?

Take Advantage of Tax-Efficient Strategies

Harvesting Tax Losses

If the market downturn has left you with some stocks that are in the red, you might use tax-loss harvesting to offset gains or reduce taxable income. By selling underperforming assets at a loss, you can immediately reinvest in a similar (but not identical) asset, maintaining your market exposure while realizing a tax benefit.

- Caution:

Watch out for the IRS “wash-sale” rule, which disallows the tax loss if you buy the same or a substantially identical security within 30 days before or after the sale.

Roth Conversions

During a market decline, the value of your traditional IRA holdings may be lower. Converting them to a Roth IRA while prices are down can be a tax-savvy move, assuming you can pay the taxes owed on the converted amount. When the market recovers, future gains in the Roth account could be tax-free (subject to certain rules).

Visit the Internal Revenue Service (IRS) website for detailed guidelines on Roth conversions and withdrawal rules.

Manage Healthcare and Insurance Costs

Health Insurance Options

Healthcare can be a significant expense in retirement, especially in the face of a down market. If you’re not yet 65 and thus not on Medicare, you might pay more for private insurance. High premiums can further strain your portfolio when it’s already under pressure.

- Strategies to Reduce Costs:

- Shop around during open enrollment.

- Consider high-deductible plans paired with a Health Savings Account (HSA), if eligible.

- Investigate Medicaid eligibility if you’re facing financial hardships.

Long-Term Care Insurance

For many retirees, long-term care expenses can be financially devastating, particularly if a market downturn hits at the same time. Long-term care insurance or hybrid life insurance policies with long-term care riders can help mitigate this risk. While these policies can be pricey, they might protect your investments from a scenario where large care expenses coincide with a recession.

Personal Experience:

A neighbor of mine had her husband in a memory care facility during the 2008 crisis. While her portfolio dropped, her LTC insurance ensured she didn’t have to sell assets at a loss to cover his care. It was a major relief in an otherwise stressful time.

Focus on Lifestyle Adjustments

Embrace Budget Flexibility

If your nest egg experiences a temporary dip, consider scaling back discretionary spending. This might mean fewer restaurant meals, postponing an expensive vacation, or reducing gift budgets. It’s not about depriving yourself; it’s about giving your portfolio room to recover without forcing large withdrawals.

Ideas to Simplify Your Lifestyle:

- Downsize to a smaller home to reduce property taxes and maintenance costs.

- Plan off-season vacations or mid-week getaways for discounted travel rates.

- Cook at home more often, turning it into a new hobby or social event with friends.

Stay Engaged Socially

Financial stress can lead to isolation, which may exacerbate worry and anxiety about market conditions. Staying engaged with community activities, clubs, or even volunteer work can help keep your focus on positive social connections rather than daily market fluctuations. Plus, volunteering offers a sense of fulfillment that doesn’t cost a dime.

Communication and Professional Guidance

Talk to Your Spouse and Family

Major financial decisions rarely impact just one person. If you have a spouse or partner, discuss your approach to a market downturn openly. Decide together what expenses could be reduced or delayed and how each of you can contribute to stabilizing your finances. This unified front alleviates confusion and helps avoid misaligned expectations.

After all, can you imagine the tension if one spouse tightens the belt while the other continues to spend lavishly on non-essentials?

Seek a Financial Advisor’s Expertise

A qualified financial advisor can help you navigate volatile markets, optimize your withdrawal strategies, and keep your emotions in check. Look for an advisor with fiduciary responsibility, meaning they must act in your best interest. Their counsel can be particularly valuable if you’re unsure about complex maneuvers like tax-loss harvesting or Roth conversions.

- Read Also:

For more tips on choosing the right advisor, check out our article on Finding a Trustworthy Financial Planner.

Avoid Common Pitfalls During Downturns

Overreacting to Headlines

Media outlets thrive on sensationalism; dramatic news often attracts clicks and viewers. Resist the urge to check your investment accounts daily or obsess over catastrophic headlines. Remember that news cycles can amplify minor fluctuations.

Draining Retirement Accounts Prematurely

Early withdrawals or large one-off expenses can have a domino effect, forcing you to sell assets at depressed prices. This can deplete your nest egg’s growth potential. If possible, explore alternatives—like using your emergency fund, taking a short-term personal loan, or adjusting monthly cash flow—before tapping into retirement accounts.

Think of your retirement fund as a giant jar of homemade jam. Savor it slowly, or risk spoiling the whole batch by leaving it exposed to the elements (i.e., hasty decisions)!

The Psychological Side of Market Downturns

Coping with Anxiety and Stress

Money worries can feel overwhelming, particularly for retirees who can’t easily “make up” losses through future earnings. Simple stress-management techniques—such as exercise, meditation, and even journaling—can help clear your mind before you make any rash financial moves.

Focus on What You Can Control

The stock market is unpredictable. Your spending habits, asset allocation, and planning strategies, however, are largely within your control. By shifting your mental energy toward proactive measures—like rebalancing, cost-cutting, or exploring additional income streams—you’ll feel more empowered and less at the mercy of market whims.

“We can’t control the wind, but we can adjust our sails.” This mindset is invaluable when navigating financial storms.

Creating a “Downturn Action Plan”

Checklist for Retirees

- Reconfirm Goals: Are your retirement objectives still feasible with minor adjustments?

- Review Asset Allocation: Rebalance if your stock/bond mix is out of sync.

- Update Budget: Identify optional expenses that can be postponed.

- Reassess Withdrawal Rate: Consider lowering it temporarily if feasible.

- Consult Professionals: Talk to a financial advisor for personalized advice.

- Monitor Progress: Check your investments periodically, but avoid obsessive tracking.

Implement a Quarterly Review

Schedule a quarterly financial check-in. During these sessions, evaluate whether market conditions have changed significantly, update your spending plan, and decide if any course corrections are necessary. This systematic approach can help you stay calm and informed without overreacting to every market move.

Conclusion

What should retired people do during market downturns? In short, stay calm, remain flexible, and plan proactively. Market dips are unsettling, but they’re also an inevitable part of the economic cycle. By maintaining a balanced portfolio, moderating your withdrawal rate, keeping a robust cash reserve, and potentially generating additional income—even in small ways—you can ride out turbulent times with less stress.

Ultimately, the key is to focus on what you can control. You can’t command the markets, but you can adjust your spending, rebalance your portfolio, and make strategic decisions to protect your nest egg. Remember, you’ve worked hard for your retirement. Let thoughtful planning—not panic—be your guiding principle.

Have you experienced a market downturn in retirement? Share your story or best tip in the comments below. If you found this article helpful, send it to a friend who might need some peace of mind during these uncertain times.

FAQs

Q1. Is it a good idea to sell my stocks and move everything to cash?

This approach can lock in your losses and potentially miss out on future rebounds. A balanced strategy with measured rebalancing typically works better than an all-cash “panic move.”

Q2. How can I protect my retirement income if the market crashes again?

Diversify your portfolio, keep adequate cash reserves, consider more stable investments (like high-grade bonds), and adjust your withdrawal rate. Also, explore additional income sources or part-time work if feasible.

Q3. Should I delay retirement if there’s a recession?

Delaying retirement can help if you need more time to build savings or wish to wait for a market recovery. It also allows you to keep earning and contributing to your retirement accounts longer, which can make a big difference.

Q4. What about annuities for guaranteed income?

Annuities can offer a steady income stream, but they come with fees and less liquidity. It’s wise to consult a financial advisor to determine if an annuity fits your overall plan.

Q5. Are Roth conversions worth it in a downturn?

They can be. When asset values are down, converting a lower amount can reduce your immediate tax burden, and any rebound in the Roth happens tax-free. However, make sure you can handle the tax payment without dipping into retirement funds.

Q6. How much cash should I keep on hand?

A general guideline for retirees is 6-12 months of living expenses in a liquid account. This emergency fund lets you avoid selling investments at a loss to cover unexpected bills.

Q7. Is it risky to buy more stocks in a downturn?

Buying quality stocks when they’re “on sale” can be advantageous if it aligns with your overall asset allocation and risk tolerance. However, consult your financial plan first to avoid overexposure to equities.

Disclaimer: This content is for informational purposes only and does not constitute personalized financial advice. Always consult a qualified financial professional to determine the best strategies for your unique circumstances.