Introduction

Have you ever stood in front of a gorgeous apartment building, daydreaming about whether to buy or rent a flat? It’s an age-old debate that can feel as tricky as navigating a maze. On the one hand, you have the allure of homeownership, a place you can truly call your own. On the other hand, renting offers more flexibility and fewer financial commitments—at least at first glance. This question matters because your decision can shape not just your monthly budget, but also your overall lifestyle and long-term financial well-being.

In this comprehensive guide, we’ll help you untangle the complexities of buying vs. renting a flat. We’ll discuss the pros and cons, uncover hidden costs, and walk through real-world examples to ensure you make the smartest choice for your unique situation. Whether you’re a recent graduate stepping into the workforce, a family seeking stability, or an empty nester downsizing, there’s something here for everyone. Let’s dive in.

Why the Buy vs. Rent Debate Matters

Personal and Financial Impact

Deciding whether to buy or rent a flat isn’t just about the walls you’ll call home—it’s about your entire financial roadmap. A mortgage can lock in a significant portion of your monthly income for decades, impacting your ability to save for other goals (like retirement or starting a business). Renting, meanwhile, might lower your upfront costs but could lead to annual rent increases and fewer chances to build equity.

Consider a scenario: If you’re paying $1,200 in monthly rent, that’s $14,400 a year not going toward building any property value. On the flip side, if you buy a flat and commit to a monthly mortgage, a portion of each payment theoretically contributes to your net worth (assuming property values hold or appreciate).

Economic Trends and Housing Markets

Global and local economic conditions can also tilt the scale. Property prices often fluctuate due to supply and demand, interest rates, and broader economic cycles. In some fast-growing cities, property values have soared, making homeownership both an excellent investment and a daunting financial leap. Meanwhile, in places experiencing population decline or economic downturns, renting might offer more flexibility and lower risk.

According to data from the National Association of Realtors, home prices in many metropolitan areas have trended upward over the past decade, but that doesn’t necessarily guarantee future appreciation. Similarly, Statista shows rising rent prices in numerous global urban centers, suggesting that renting can also become expensive over time. Understanding these shifts is critical as you weigh your options.

My friend Rahul once bought a condo at the peak of the market boom. For the first few years, he worried he’d overpaid. But after about five years, his neighborhood developed rapidly, and his condo value jumped substantially. His experience shows that timing and local market conditions can drastically influence whether buying is a great deal—or a headache.

Pros and Cons of Buying a Flat

Pros of Buying

- Equity and Investment Potential

Buying a flat essentially forces you to build equity over time. Each mortgage payment chips away at the principal, growing your stake in the property. If home values rise, you may gain additional financial benefit in the form of capital appreciation.- Long-Term Wealth Building: Real estate can act as a hedge against inflation and provide a stable asset in your portfolio.

- Rental Income (If You Move Out): You could convert your flat into a rental property later, generating passive income.

- Freedom to Renovate

Love the idea of tearing down a wall to create a bigger kitchen or turning the guest bedroom into a stylish home office? As a homeowner, you have creative control (within local building codes, of course). You don’t need a landlord’s permission to make cosmetic or structural changes. - Predictable Housing Costs

If you opt for a fixed-rate mortgage, your monthly principal and interest remain constant throughout the loan term. While property taxes and insurance can fluctuate, your basic mortgage payment won’t rise like rent often does. - Emotional Satisfaction

For many, owning property brings a sense of pride and security. You can plant a garden, adopt pets without restrictions, and settle in a community with the comfort of knowing the space is truly yours.

Cons of Buying

- High Upfront Costs

Purchasing a flat typically involves a down payment (often 5-20% of the property price), closing costs, and other fees like inspections or appraisals. For example, a $300,000 flat might require a $30,000 down payment if you go with a 10% deposit. Not everyone has that much cash on hand. - Maintenance and Repairs

As a homeowner, you’re on the hook for everything—from a leaky faucet to a failing roof. These repairs can be expensive and unpredictable. Over time, you might spend thousands on renovations, furnishings, or emergency fixes. - Less Flexibility

Selling a property can be more complex and time-consuming than ending a lease. If you get a job offer in another city or need a bigger space quickly, you can’t just give a month’s notice. Plus, you’ll pay closing fees, realtor commissions, and possibly capital gains tax if you sell after a short period. - Market Risks

Property values can fall. If you buy at the wrong time or the local market slumps, you could end up with a house that’s worth less than your mortgage. The 2008 financial crisis taught many homeowners how devastating negative equity can be.

Personal Experience:

I remember purchasing my first flat a few years ago. I felt incredible pride that day, only to face a broken water heater in the very first month—surprise repair costs right out of the gate. Owning property can be joyous, but it certainly keeps you on your toes.

Pros and Cons of Renting a Flat

Pros of Renting

- Lower Upfront Commitment

Renting generally requires a security deposit plus the first and sometimes last month’s rent. That’s still a few thousand dollars, but much less than a typical down payment on a house or condo. If your savings are tight or you prefer to invest your capital elsewhere (e.g., stocks, a startup, or a child’s education), renting can free up your resources. - Flexibility and Mobility

If you’re unsure about your long-term plans—maybe you anticipate moving for work or traveling extensively—renting offers a quick exit strategy. You often only need to provide a 30- or 60-day notice before moving on. - No Maintenance Hassles

When the fridge breaks down or the plumbing leaks, it’s your landlord’s responsibility to fix it. This means fewer surprise expenses and less stress about finding reliable contractors. - Predictable Monthly Costs

While rent can increase upon lease renewal, your monthly housing cost is still more straightforward in the short term. You won’t face unexpected property tax hikes or massive repair bills.

Cons of Renting

- No Equity Built

Each check you write to the landlord disappears into someone else’s mortgage or pocket. You’re not building equity, which can feel like a missed opportunity to grow your net worth. - Limited Control Over the Space

Want to paint the walls a bold color or tear out the carpeting? You usually need your landlord’s permission. Significant changes or renovations are often out of the question, so personalization can be challenging. - Uncertain Lease Terms

Your landlord could sell the property, raise the rent drastically, or decide not to renew your lease. This uncertainty can create extra stress if you value stability in your living arrangements. - Potential Restrictions

Some landlords prohibit pets, smoking, or certain activities. And if you have a large family or unique hobbies (like playing the drums), renting might limit your lifestyle choices.

Relatable Analogy:

Think of renting like staying in a hotel—someone else handles the upkeep, and you can leave relatively easily, but you’re paying for a space you’ll never own. Buying is more like owning a cabin in the woods—greater freedom, but also greater responsibility when the roof leaks.

Key Factors to Consider

Financial Health and Budget

Before you decide, examine your monthly income, existing debts, credit score, and savings. Can you comfortably handle a mortgage payment alongside insurance, utilities, and potential upkeep? Or would renting free you up to diversify your investments elsewhere?

- Tips:

- Use mortgage calculators from reputable sites like Bankrate to gauge monthly payments.

- Create a detailed budget including all housing costs—mortgage or rent, taxes, insurance, HOA fees, maintenance.

Lifestyle Preferences

Are you someone who craves the stability of planting roots, making your home truly your own? Or do you prefer the flexibility to move cities—or even countries—on short notice? Think about whether you enjoy the idea of renovations and yard work or if that feels like a chore.

Job Security and Location

Is your job stable, or is there a chance you’ll relocate soon? If you’re unsure you’ll stay in the same area for at least three to five years, buying might be risky because of the transaction costs involved in selling. Meanwhile, renting can be more cost-effective if you anticipate frequent moves.

Future Plans (Family or Otherwise)

If you’re planning to start a family or need extra space for parents who might move in, factor that into your decision. Buying can offer the option to expand (if you have the means to upgrade or add rooms), but renting might limit your ability to accommodate changing family sizes.

Pro Insight:

Many financial experts suggest a minimum five-year stay to offset closing costs when you buy. Less than that, the investment might not have enough time to appreciate or break even, especially in slower markets.

Hidden Costs and Fees

Renting-Related Fees

- Security Deposit: Typically equivalent to one month’s rent, refundable if you leave the unit in good shape.

- Pet Fees or Monthly Pet Rent: If you own a pet, some landlords charge extra.

- Renters Insurance: Not always mandatory, but often recommended. This covers personal belongings but adds to monthly expenses.

Buying-Related Fees

- Closing Costs: Can range from 2-5% of the property price, including attorney fees, appraisal, title insurance, and more.

- Property Taxes: Vary by location; some regions have significantly higher tax rates, which can add hundreds or thousands to your annual costs.

- Homeowners Insurance and HOA Fees: If you buy a flat in a building, you may also pay monthly Homeowners Association (HOA) fees for maintenance and shared amenities.

- Maintenance and Repairs: Rule of thumb suggests budgeting 1-2% of your home’s value annually for upkeep.

Quick Example:

If you purchase a $300,000 flat, you might face $6,000 to $15,000 in closing costs, plus an annual property tax of around $3,000 (assuming a 1% rate), and maybe an HOA fee of $200 per month. These add up quickly, so thorough research is crucial.

Crunching the Numbers: A Simple Case Study

Scenario Setup

Let’s imagine two friends, Aria and David, both needing a flat in the same city:

- Aria (Buying)

- Buys a $250,000 flat with a 10% down payment ($25,000).

- Takes a 30-year fixed mortgage at 4% interest, making her monthly mortgage (principal + interest) about $1,194.

- Budgeting $2,500 a year for property taxes, $1,000 for homeowners insurance, and $2,000 for maintenance.

- Monthly estimate: $1,194 + $208 (tax) + $83 (insurance) + $167 (maintenance) = $1,652.

- David (Renting)

- Rents a comparable flat at $1,300 monthly rent.

- Pays a $1,300 security deposit.

- Buys renters insurance at $15/month.

- Total monthly: $1,315, which includes rent + insurance.

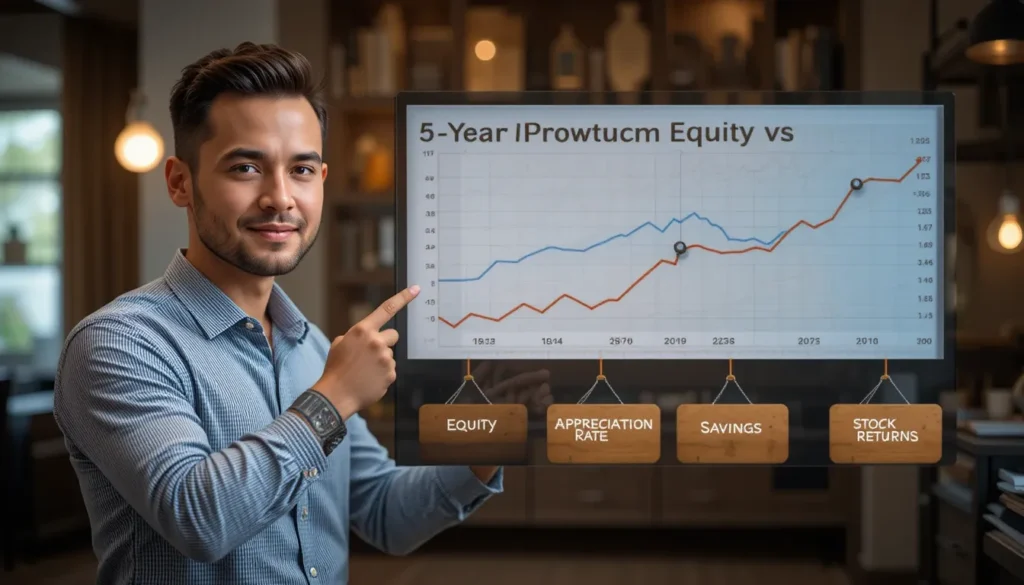

Five-Year Projection

- Aria

- Total mortgage payments for 5 years: $1,652 × 12 months × 5 years = $99,120.

- Aria also put down $25,000 initially.

- If her flat appreciates at 3% per year, it might be worth about $289,000 after five years. Aria might still owe around $200,000 on her mortgage.

- Her estimated equity could be $89,000 in the property (value minus mortgage balance).

- David

- Total rent for 5 years: $1,315 × 12 months × 5 years = $78,900.

- He invested the $25,000 he didn’t use as a down payment in a diversified stock portfolio, which hypothetically grows 5% per year. After five years, it could be around $31,900.

- David has no property equity, but also doesn’t deal with maintenance headaches or potential market downturns in real estate.

Takeaway: After five years, Aria might have more net worth tied to her home, but also faced higher monthly bills and risk. David has flexibility and extra investable cash, but also risk in the stock market, and no chance of building home equity. Which scenario is “better” depends on personal comfort with real estate, future market conditions, and lifestyle preferences.

Balancing Lifestyle and Financial Goals

Setting Priorities

- Stability vs. Flexibility: Do you need the security of having a permanent home base, or do you thrive on mobility?

- Forced Savings vs. Liquidity: Owning a home is like forcing yourself to save through mortgage payments. Renting allows more liquidity—useful for investing or emergency needs.

- Emotional Fulfillment: Homeownership can be deeply satisfying, but some find it restrictive. Are you okay with the time and cost of maintenance?

The “Rent and Invest” Approach

Some people adopt a middle path: continue renting to enjoy flexibility and invest aggressively in stocks, bonds, or other vehicles. If these investments outpace real estate appreciation, you could accumulate wealth faster than through a mortgage. However, if the stock market underperforms, you might miss real estate gains. This approach typically suits those comfortable with market volatility and mindful of disciplined investing.

Imagine if you used the down payment funds to start a thriving online business. Could that yield more profit than a modest increase in property value? Possibly—if you have entrepreneurial drive. Alternatively, property could be your anchor if you prefer a more predictable path.

Additional Tips for Making the Right Choice

Do a Trial Run

If possible, try living in a rental home that mirrors your desired lifestyle. For instance, if you plan to buy a flat downtown for $2,000 per month in mortgage costs, rent a place with a similar monthly cost. See how your budget and daily life fare with that expense.

Consult Professionals

Engage with real estate agents, mortgage brokers, and financial advisors to gather insights on local market conditions, loan options, and investment strategies. Each professional can shed light on aspects you might not have considered, like:

- Potential tax deductions for homeowners.

- Mortgage interest rate fluctuations.

- Best times to negotiate rent or purchase a property.

Factor in Opportunity Costs

When you commit funds to a down payment, you’re tying up money that could go elsewhere—like a retirement fund, mutual funds, or personal business ventures. Evaluate which route offers the highest potential return aligned with your risk tolerance.

Future Mobility Plans

Don’t overlook your future lifestyle. Retirees or individuals who anticipate relocating might lean toward renting to avoid the hassle of selling. Meanwhile, if you’re confident you’ll stay put for a decade or more, buying can become increasingly appealing.

Humor Moment:

Picture yourself chasing a dream job in Europe. Owning a flat you can’t sell quickly might chain you down—like an anchor on your wanderlust boat. Renting might let you set sail at a moment’s notice!

Conclusion

So, what’s the smarter choice—to buy a flat or rent one? There’s no universal answer. It boils down to your financial capacity, risk tolerance, lifestyle preferences, and long-term goals. Buying can be a powerful way to build equity and enjoy creative freedom in your home, but it comes with significant upfront costs and responsibilities. Renting offers flexibility, fewer maintenance burdens, and potentially more investable cash—but you won’t build direct equity in the property.

Ultimately, consider how stable your income is, how long you plan to stay in one place, and where else you might invest your resources. Run the numbers. Weigh the intangible benefits of ownership against the perks of renting. And remember, the housing market is always evolving. What seems like a great buy today could be tomorrow’s regret if you’re not prepared for the long haul—and vice versa.

If you’re still on the fence, share your biggest concern in the comments below. Or, if you’ve already made a decision, tell us what tipped the scale for you. Let’s crowdsource some wisdom to help everyone navigate this big financial step!

FAQs

Q1. Is it cheaper to rent or buy in the long run?

It depends on factors like location, housing market trends, interest rates, and how long you plan to stay. Over decades, homeowners often build equity, which can make buying cheaper in the long run—provided you’re ready for the initial costs and responsibilities. However, if you move frequently or your local market is overpriced, renting might be more cost-effective.

Q2. How much down payment do I really need to buy a flat?

While 20% is traditionally recommended to avoid private mortgage insurance (PMI), some lenders allow as little as 3-5%. Keep in mind that smaller down payments mean higher monthly mortgage bills and possible PMI, increasing your overall costs.

Q3. What if property values drop after I buy?

Real estate values can fluctuate. If you’re planning to stay for the long term (5-10 years or more), you’re more likely to ride out short-term dips. But if you need to sell during a market downturn, you risk selling for less than your purchase price or even less than what you owe on the mortgage.

Q4. Do I lose money by renting?

Renting doesn’t build home equity, but that doesn’t automatically mean “wasted money.” Many renters invest the difference they’d otherwise pay in a mortgage, potentially earning returns in stocks or other assets. Plus, renting saves you from maintenance and repair costs.

Q5. What about rent-to-own deals?

Rent-to-own arrangements allow you to rent a property with an option to buy later. A portion of your rent may go toward the eventual purchase price. While it can be a stepping stone for those who need time to build credit or save for a down payment, read contracts carefully—terms can be complex, and you may pay a premium in rent.

Q6. Should I hire a financial advisor before deciding?

Yes, if you’re uncertain about your long-term financial plans or how homeownership fits in, consulting a financial advisor is wise. They can assess your budget, investment goals, and risk tolerance to provide personalized advice.

Q7. How do I handle maintenance costs when buying a flat?

Budgeting is key. Many experts suggest setting aside 1-2% of the property’s value each year for maintenance and repairs. If your flat has an HOA, factor those fees in as well, since they often cover communal upkeep but can also be increased if major building repairs are needed.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial or legal advice. Always consult qualified professionals for guidance specific to your situation.